I was imagining the following purely as a speculation for the Netherlands. Like most things I write it is purely a speculative exercise, and free flow of ideas and associations within the context of the Netherlands. Feel free to follow me in my exploration, and maybe you’ll get inspired along the way.

Imagine someone in the Netherlands would head out in to the sea, steering a large vessel over a submerged elevated ‘sandbank’ – a row of dunes just out of shore, just a few meters under the sea.

And what if this enterprising individuals convinced some friend go along, and “claim” a small artificial island there — initially just poles and beams, and erect a small colony on elevated concrete stilts. Of course the Dutch government would initially object to such antics, but let’s say there would be just enough time for a community of several dozen to settle down there, reject the status quo regulations and refuse to be ousted by central state oppression. It would be the perfect publicity stunt. Imagine these people would be living on elevated weatherproofed containers one year, but by careful change of currents, dumping of concrete blocks they would force the sea to deposit sediment, or by whatever ingenuity and luck they’d create the formation of a small island. Just a fairly small investment and the colony would become a permanent form of free-spirited political expression. This has been tried before a few times (1, 2)

Now extrapolating from that naive and simplistic idea, there may one day be an artificial island just outside the normal geographic constraints of the Netherlands. Now lets assume the major of this small island would be free to attract some investors for much needed social, legal and technological innovation in the stale and stagnated Netherlands.

The Netherlands is currently in large part defined by fairly “assertive” style of Government interventionism … One part of this intervention can be classified as fairly benevolent (i.e. the welfare state), but other parts of this intervention may be regarded as pathological disruption of free markets. A great example of this government policy results in de facto over-subsidization in the national housing sector. This branch of domestic industry benefits from a reduced tax tariff for mortgage, or “mortgage interest rate deduction”. As a result many house owners lived on the cheap (or they did initially…). They didn’t pay taxes over the purchase (finalialization) stage of acquiring a house. But over time this benevolent influence rapidly changed in to something more sinister.

As a result of this easier access to financing many Dutch are effectively over-leveraged population in terms of collective private debt. It got so worse that even the IMF started complaining (1).

I may enter in to some modest conspiracy thinking here. As an example – in general states likes house owners shouldering high mortgages. This might even a feature, rather than a bug evolved over time. We may assume no one planned this, but in retrospect this policy makes a lot of sense. Hard working employees in the Dutch working classes having to render high mortgage and housing maintenance costs can not afford to become unemployed or go on strike. These people invariably have a wife to also pay part of the mortgage and that more or less implies they’ll spawn and have their societally benevolent allotment of equally expense infants. To turn around the corner of full conspiracy thinking it can be assumed that most of these kids will be blue-eyed and blonde in the Netherlands since for some historical and cultural reasons those of more skin pigmented persuasion tend to have markedly less access to stable jobs and mortgages. If it works, it works.

The end result of an implied government subsidy is the current reality of unsustainably inflated prices for land acquisition. The Netherlands (as is Japan) is in sharp competition for real estate and land, and this drives up the price of real estate. At the same time most developed economies may be in permanent decline as true energy cost (rather than the relative abstraction of currency price) constrains economic growth to well under 2%. While high property values (again, measured in the vagueries of contextual economic fictions) are welcome with local municipal authorities and their rapidly escalating taxation needs, these burdens sharply reduce consumption of goods and services. Authorities are under no compulsion of any kind to ever lower these tariffs, or otherwise reinterpret land values to a new economic context. The underlying mechanism might feel similar to a game of chairs, or a pyramid game to the perceptive. Once the music starts, someone, somewhere is losing in a proverbial Red Queen Race (1). The Netherlands has its own rather sedate, domesticated manner of responding to all this, courtesy of the Poldermodel (1) and ever since I have lived in this country of domesticated hobbits I have seen housing prices go up.

All this became subject to the dictates of the outside world in 2008, as the international stock market collapsed. Max Keiser constantly reminds us why this happened – too much magic money introduced arbitrarily by bankers in to a closed system. Result, inflation and overfinancialization. In other words – every half horse head and his lame dog in the US could get a mortgage, consequently everyone is over his neck in debt. Banks repackaged these debts in the same manner certain businessmen would hide rotting fish heads in barrels of kaviar, and now the whole global financial business has become thoroughly infested and contaminated. It is clear why this happened – the US had to conduct some wars, to bolster the fiction of an America that would project its benevolent globalized capitalist system on to the world in the same manner the benevolent Jesus might be found in a brothel healing the afflicted “by laying on hands”. So when this ended in 2008 (1) there was no other recourse to the banking sector than spend the next decade (in which we are only wayway in) to desperately try fill all the holes they dug themselves in to. Banks went under, especially a few of the the more adventurously inclined banks, and some countries enter an irreversible decline in to undeveloped debtor nation world status. In the Netherlands this had unpleasant consequences, but nowhere near as gruesome as in the PIGGS. I was in Tenerife last year and could easily spend an half hour circling abandoned building sites scattered in the area on my bike. The Dutch found themselves locked in to houses they were unable to sell, which can be particularly unpleasant whenever couples are hit by something like divorce. I have heard horror stories as banks simply didn’t allow for a sale at a reduced price. In the Netherlands debtors can have debts permanently cancelled over a three year timespan, a process I am fairly personally familiar with. Banks are concerned about this contingency as in many cases the debtors might revert to insolvency court. In such special cases the banks would end up holding an empty bag. Correct me if I am oversimplifying here, I never wanted a mortgage I am no specialist in that area.

The deterioration of Dutch real estate didn’t curtail itself to private housing. In the Netherlands there now (as is the case in many European cities) a substantial surplus in office space. 1. Right now eight millions of square meters, or 16% of all office space stand deserted. That means the respective owners do not receive rent for their investments which is in itself fairly bad, but not as awful as having to write off on the value of the respective Offices. In many cases pension funds and banks invested in real estate, and this property represents a substantial real estate value. This value has become mostly a fiction (1). Local laws about building codes, or local municipal governments sharing beds with real estators, one way or another, add to this market opacity. A devaluation of both housing value as well as investment properties is inescapable in most of the ‘developed’ world. It is becoming arguable, if not self-evident, that technological advances and automation are eating away at the need for office space. In a few years we will likely need even less office space. So the only logical consequence, were we to inhabit an actual free market, was to devalue the actual value of offices to the point where it would become profitable to turn this real estate in to luxury apartments. Right now offices are considerably more expensive per square meter than houses, especially to rent.

Sadly, when that starts happening, the value of normal houses will cascade down as well, destroying even more of these monopoly money investments. The money will have to disappear from the system, one way or another, and like the aforementioned game, those in power are doing their damn best the loser in this charade will be the taxpayers. The alternative – banking defaults, local municipal default, investment fund default, pension fund default is too worse to contemplate and transcend any rationally deliberate policy analysis.

Right now no one in any semblance of power can afford to rock the table and make the house of cards keel over. Not pension funds (who invested in the imaginary value of private mortgage and office spaces), no local municipal governments (who desperately need every penny of tax money they can get their hands on), and certainly not the owners (who in many cases would be so much under water they might be declared insolvent).

I think the Netherlands is a great country in many ways, but it’s getting less pleasant, and disparity of property and wages is one reason for me to increasingly less like the country I am living in. I wouldn’t mind seeing some more rational real estate values, and at the same time more space, more opportunity for expansion, more opportunities for work, more economic growth (especially of the fictional kind, i.e. actual creation of value) and substantially better and more egalitarian living conditions. I think a huge number of people in the Netherlands are mistakenly assuming they are millionaires, because they own a house.

Here’s an idea that has been floating around my head in one way or another.

Anyone in the Netherlands can crowd source funds to generate capital to come up with private projects. If sufficient people express this desire then local and national politicians would have little choice than to accommodate these people. Right now several million people in the Netherlands live in either unaffordably expensive rented houses, or have to endure an absurdly overinflated mortgage, or live in a cramped apartment. Entrants in the housing market can’t find a place, especially in or near the Randstad.

The Dutch have a fine tradition of facing the rising sea. It’s almost a cliche. Balkenende kept yammering on a few years ago about The Golden Age. This “golden age” was a reference to an era of aspiration, technological progress, collectively shared wealth and ambition. It was also an era of collective national irreverence paired with tolerance for people of different ideas.

What if a private fund of investors would work to create an island just along the shore of the Netherlands?

This idea isn’t anything new 1, 2 – it has been happening for decades along the terminal of Rotterdam port, and over the last centuries it is pretty much the way the Netherlands formed. The only reason this process stopped in the last few decades was probably because the average age of the Dutch is increasing, and most Dutch aren’t accustomed to thinking in big land reclamation projects any more. They are clearly focusing on Hobbit pursuits rather than head out for adventure, to say it in a more condescending manner. For a large comparably ambitious investment entity such as Rotterdam it makes perfect sense to pump up large artificial islands. For private ownership might seem a little too expensive. But let’s assume that isn’t the case. Let’s do a little back-of-the-napkin calculation.

I am not anything a proximating a specialist in these matters, so if you have any better calculations do email me with suggestions. I will add updates to this article based on any better suggestions.

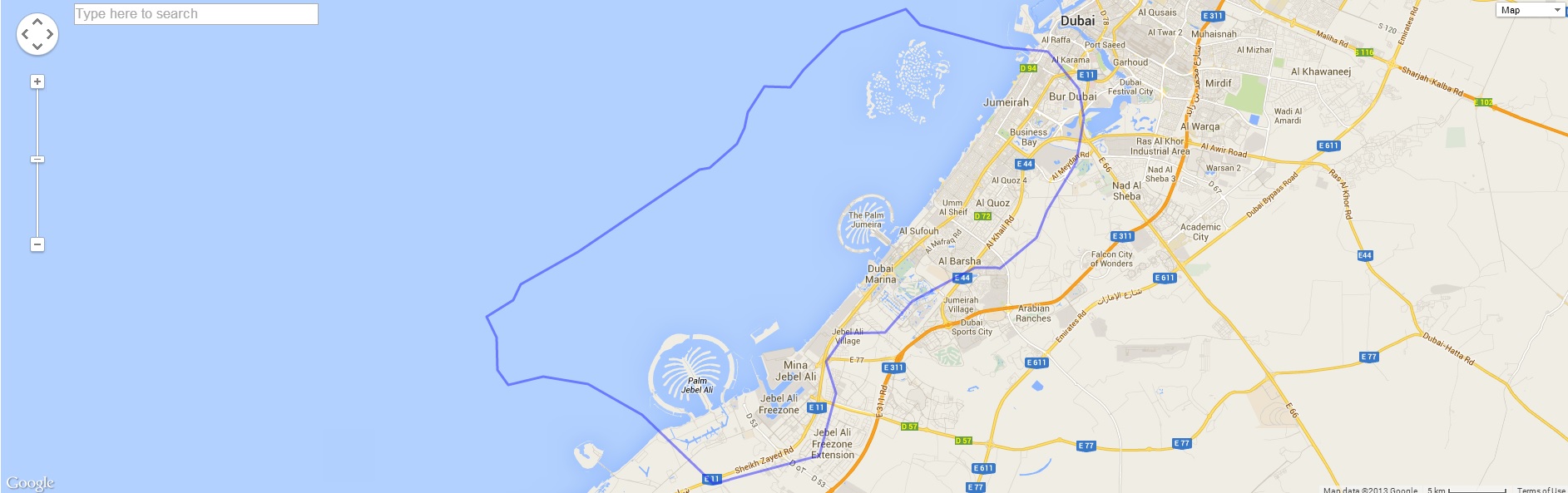

Here is the map of the Netherlands and in this article you see the progress of land reclamation. Clearly the ongoing MaasVlakte project is somethat that’s big enough to be visible from Earth orbit.

The total cost of the land engineering project at the Maasvlakte is about 2.9 billion 1.

If an equivalent amount of real estate would be pumped from the sea mud and deposited in to two strips of equal size along the dutch shore (somewhat like was done in Dubai) it wouldn’t cost much more, probably less. The Flevopolder used to cost “in the range of a few hundred million guilders”, but lets safely assume that was a long time ago, and we might end up ten times to a hundred times as expensive in current costs. The most potentially profitable land is along the cost of Randstad, essentially near Rotterdam, the Hague, Leiden, up to Amsterdam and precisely the parts with the most absurd inflated real estate costs in the Netherlands.

Now let’s assume more than a million Dutch have problems finding a decent house right now. Many of these would prefer a coastal house. And let’s assume ground price and municipal taxes would be the biggest hurdle for these outbidded citizens in aquiring satisfying real estate. What if a million Dutch would collectively shoulder the burden of creating a strip of artificial land from Hoek van Holland all the way to Noordwijk, construct dikes, add roads, add a forest along a strip of land no wider than a few kilometer, running the length of the coast. This project would add to the existing protection of the Dutch coast from the rise of the sea level, so this would be doing all the other Dutch a big favor. Add infrastructure and some bridges. If the total cost would have to be within the means of one or several million Dutch people, the construction prices of actual houses would have to become extremely cheap, compared to existing costs.

Now here is where it gets tricky. The people who might contemplate living there would want comparatively cheaply constructed yet high quality housing.

As it happens, a whole new industry of cheap and extremely high quality housing is starting to emerge right now, with 3D printed houses (1, 2), mass production cost of quality houses could be lowered from the currently absurd levels to probably well under 50 thousand euro. Right now petty zoning laws and builder monopolies push up housing prices to absurd levels.

The point is to get rid of monopolies. Ignore existing inflated Dutch real estate money-sharks and implement a totally independent building infrastructure. Attract a mass of Easter European workers and ignore local building permits, regulations, annoyingly suffocating Dutch zoning and building code laws – this is totally new land, right? You should be able to do pretty much anything you want here.

A strip of coastal real estate like this would introduce at least a million new high quality houses in the real estate mix. You’d be fishing for low cost building companies all throughout the European Union, and bypass and ignore any local nuisance high cost builders. Paste the whole stretch of coastline full of fast growing trees and all a seamless line of wind-turbines and robust weatherproofed solar arrays along the seaward dike, offering anyone living there vastly reduced electricity costs year around.

The municipal governments from any part of the Randstad would be terrified of such a plan, and would respond with hysteria and hostility. Banks, investors, pension funds, owners of expensive homes – all would respond with characteristic recalcitrance of geriatric monopolists. If this were implemented in a decade by the tenth year housing costs in the western half of the Netherlands would be in sharp decline as supply would sharply increase. Sadly we don’t live in free markets, as should be self-evident by now.

In setting up this project the people bidding for housing would probably get funding from foreign investers many of whom are currently rather desperate to find a place to store their money. By attracting foreign financing the party facilitating this project for their clients Dutch would be able to renegotiate many local banks, and thus secure attractive rates in the process. But still local and state governments would put up a fight as this plan destroys the precariously exploitative high tax rate nest egg the Dutch money elites creates to their own benefit.

The plan would be a painful legal battle all the way to the last house being built, but the struggle would be well worth it. Sea-side coastal housing in the west facing the sea, or on the east facing a newly created inland lake as big as the Ijsselmeer. With very large houses, very favorable real estate permits and lax building codes, using completely new and experimental 3D house printing technologies that would otherwise not be legal on mainland Netherlands for decades.

But most of all it is to use ingenuity to offer people opportunities for increased freedom and substantially better life. There’s still hope for the future, but these days you may have to part the seas to actually realize such an ambition.

Updates: Rewritten on account of loads of errors; old edited version placed on the pirate party page here by Nienke. On the NL forums there is some buzz going on on this article here. It ruffles feathers.

![3_14-schwimmende-siedlungen[1]](http://khanneasuntzu.com/wp-content/uploads/2013/10/3_14-schwimmende-siedlungen1.jpg)