For years, Tesla has been at the forefront of the e

lectric vehicle revolution, pushing innovation, defying industry norms, and amassing a near-religious following. But beneath the shiny exterior lies a stark reality: Tesla’s finances have never been as solid as the hype suggests. Elon Musk’s erratic behavior, mounting legal troubles, and Tesla’s increasing reliance on debt, stock dilution, and government subsidies paint a troubling picture. If Tesla collapses—either through bankruptcy or an operational implosion—the consequences could be far worse than most people expect.

We may be far closer to such a scenario than most investors and consumers realize. In this worst-case examination, we explore what happens when Tesla goes belly-up—how service grinds to a halt, cars become bricked, repair shops shutter, charging stations fall into disrepair, and millions of Tesla owners find themselves stranded.

The Warning Signs: Why Tesla Might Be Closer to Collapse Than You Think

Tesla’s Financial House of Cards

Tesla, despite its meteoric stock valuation, is far from invulnerable. The company has relied on selling regulatory credits, massive debt, and issuing new shares to keep its books afloat. With rising interest rates, declining vehicle demand, and increasing competition from legacy automakers and Chinese EV companies, Tesla’s margins are getting squeezed hard.

Additionally, Tesla slashed prices throughout 2023 and 2024 to maintain sales momentum. While this helped short-term delivery numbers, it devastated profitability. As revenue per car dropped and operational costs remained high, Tesla’s once-impressive margins shrank to a fraction of their former glory.

Musk’s Self-Destructive Spiral

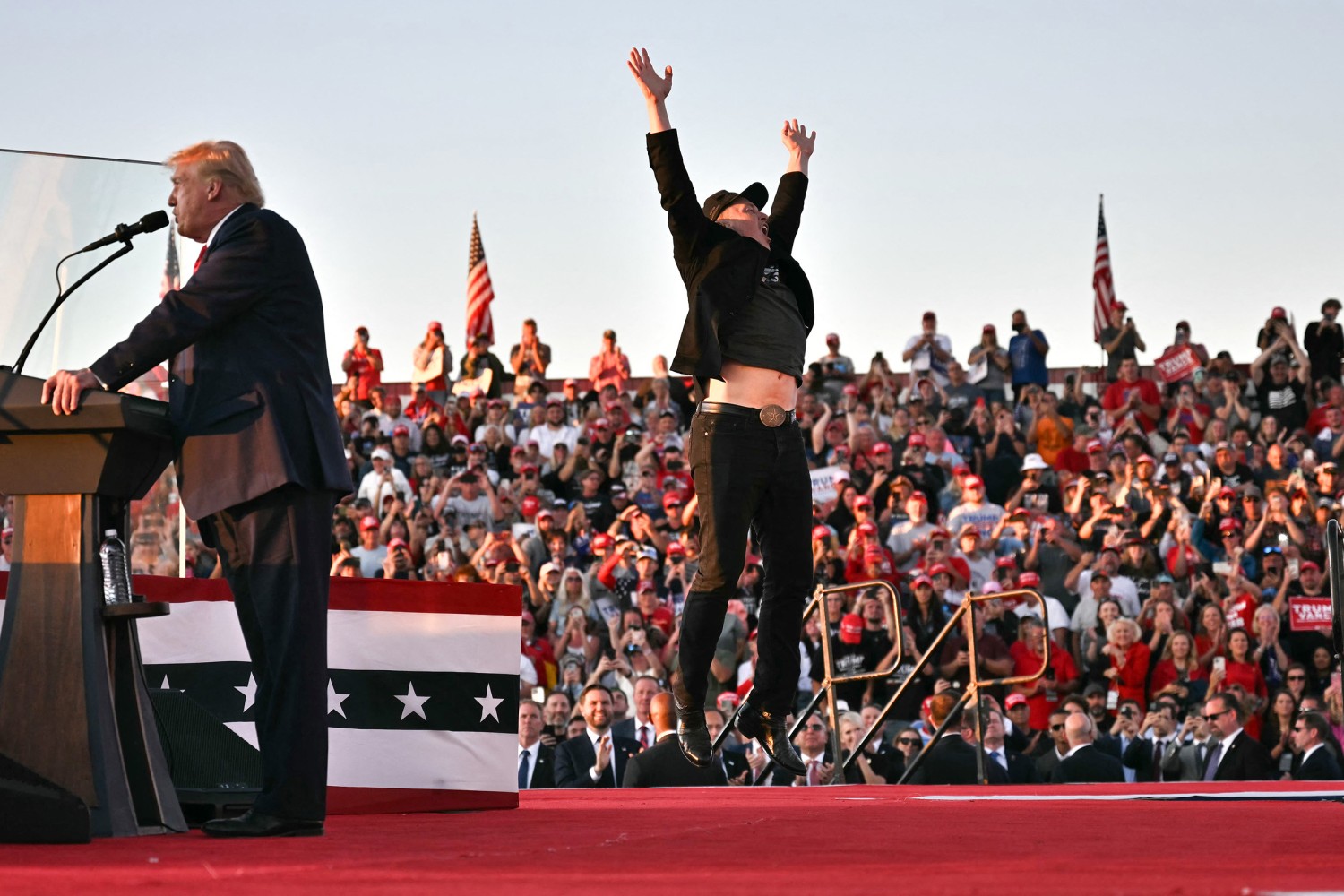

Elon Musk’s antics—ranging from alienating investors to sinking billions into Twitter (X) and engaging in political rants—are becoming a liability. His distractions have already impacted Tesla’s brand image, particularly among key demographics like liberal-leaning EV buyers. The more Musk involves himself in social media feuds and legal battles, the less attention is given to the company that built his fortune.

Beyond his chaotic leadership, Musk’s personal life has become a spectacle, with increasing evidence of his ongoing narcotics adventures influencing his erratic decision-making. He has also deeply embedded himself into Trump’s increasingly sordid political ecosystem, aligning Tesla with a highly divisive movement that risks alienating investors, regulators, and key consumers.

What’s more, Musk’s interference in European politics has made him a target for outright vandalism, protests, retalliation, highly visible hit pieces and boycotts. With this election meddling and sophomoric antics in the political sphere he has caused literal hundreds of millions of people to viciously hate him and his brands.

Moreover, Musk’s personal financial entanglements with Tesla are concerning. His leveraged use of Tesla stock as collateral for loans and his increasingly risky financial maneuvers make him a ticking time bomb. He also underwrote his buyout of Twitter using Tesla stock—an acquisition that has since hemorrhaged money. If Twitter collapses under its massive debt burden, Tesla may follow, as Musk will be forced to liquidate even more shares to cover his losses.

Overextended and Owned by China

Musk is overstretched across multiple ambitious projects—Tesla, SpaceX, Neuralink, The Boring Company, and Twitter. His empire is spread thin, leaving Tesla vulnerable if any of these ventures encounter a financial meltdown.

Additionally, Tesla’s dependence on China is a looming liability. The Chinese government effectively owns Musk “by the balls,” given that Tesla’s Shanghai Gigafactory is integral to its global production. If Beijing ever decides to leverage Tesla for political purposes, it could dictate terms that devastate the company’s Western operations or even force Tesla into uncomfortable concessions that further damage its brand.

Rising Competition & Market Saturation

Tesla is no longer the only game in town. Ford, GM, Hyundai, and Chinese companies like BYD are aggressively eating into Tesla’s market share. The flood of affordable, high-quality EVs means Tesla’s dominance is no longer guaranteed. Meanwhile, Tesla’s aging lineup and failure to deliver long-promised innovations (Cybertruck delays, the now laughable “full self-driving” promise, etc.) are eroding consumer trust.

If demand continues to soften, Tesla may be forced into a financial death spiral of lower prices, lower margins, and reduced cash flow—eventually leading to insolvency.

The Collapse Scenario: When Tesla Goes Dark

Cars Stop Working Overnight

Tesla vehicles are heavily reliant on cloud-based systems, and if those services stop functioning, essential features could be disabled. In a bankruptcy scenario:

-

Remote authentication might fail – Tesla owners rely on their app and servers to unlock their cars. A shutdown could make vehicles inaccessible.

-

Software updates and security patches cease – Bugs and vulnerabilities will not be fixed, leaving cars increasingly vulnerable.

-

Supercharging stations go offline – Without Tesla maintaining its network, Superchargers could shut down, leaving owners without reliable charging options.

Repairs Become Impossible

Tesla’s proprietary repair model could turn from an annoyance into a catastrophe. In a collapse scenario:

-

Tesla Service Centers shut down – Official repair centers would close, leaving millions of cars without maintenance.

-

Parts supply dries up – With Tesla no longer manufacturing or distributing spare parts, repairing even minor issues could become impossible.

-

No third-party repair options – Unlike traditional automakers, Tesla has fiercely resisted independent repair shops. If the company vanishes, most repair knowledge and supply chains vanish with it.

- With no tesla investments in software security, any cars on the road might become very vulnerable to hacks, exploits and cyberattacks.

Charging Networks Deteriorate & Get Vandalized

Without Tesla maintaining its infrastructure, the Supercharger network could rapidly decay:

-

Software dependencies cause failures – Many chargers require backend services for payment and authentication, which could stop working.

-

Vandalism and looting surge – Stranded, abandoned Supercharger stations would become prime targets for copper theft and vandalism.

-

Grid operators shut off electricity – If Tesla stops paying energy bills for charging stations, providers might cut power, rendering them useless.

Dealerships & Resale Market Crumble

Unlike traditional automakers, Tesla has no independent dealership network. In a collapse scenario:

-

Tesla stores shut down instantly – With no dealership safety net, Tesla’s entire sales and service network would vanish overnight.

-

Used Teslas lose resale value overnight – With uncertainty over future serviceability, Tesla vehicles could become near-worthless.

-

Customers stuck in lease limbo – Leasing agreements and financing plans could become a legal nightmare if Tesla’s financial arm goes bankrupt.

What If You Are Driving in the Middle of Nowhere and Your Tesla Just Stops?

A worst-case scenario for many Tesla owners would be a total system failure while driving in a remote area. If Tesla’s network collapses and software authentication locks vehicles out, the consequences could be severe. Possible risks include:

-

Sudden loss of power – If Tesla’s servers shut down abruptly, some cars could become immobilized due to over-the-air dependency on key vehicle functions.

-

No emergency roadside assistance – With Tesla’s service network gone, there would be no official Tesla assistance, leaving owners to rely on tow trucks that may not have the right equipment to handle electric vehicles.

-

Charging station shutdowns – If a Supercharger in a remote area is no longer functional due to Tesla’s failure, drivers could be left stranded with no way to recharge.

-

Temperature-related dangers – In extreme weather conditions, a stalled Tesla could become a death trap if heating or cooling systems shut down.

Tesla owners who frequently travel through remote areas should consider backup options, such as carrying an emergency power source, knowing how to manually access their car, or having a plan for alternative transportation.

Conclusion: A Fragile Future

Tesla has been a trailblazer, but its financial fragility and Musk’s erratic leadership make it far more vulnerable than many realize. While a full-scale collapse is not inevitable, the warning signs are impossible to ignore.

If Tesla does go under, it will not be like a typical car company bankruptcy—where assets are sold and operations continue. Instead, the entire ecosystem could collapse, leaving millions of customers stranded, service infrastructure decimated, and the broader EV industry thrown into chaos.

It is time to prepare for the worst before the worst arrives.

“If Musk disagrees with this analysis, he’s more than welcome to challenge it in a Dutch court. But something tells me he has bigger problems to deal with than an inconvenient opinion piece—like keeping Tesla afloat.”